Posted in Chronicle Blog by Scott Morgan

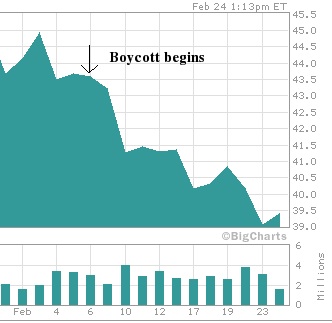

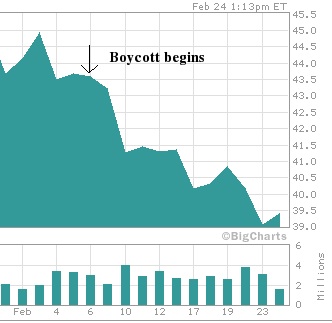

I'm no expert on the stock market, but this doesn't look good for Kellogg's:

As the chart shows, the company's stock took an immediate dive following its decision to drop Michael Phelps over the infamous bong hit photo. What began as a coordinated boycott by drug reform organizations quickly escalated into a full-blown media frenzy as major news outlets picked up the story. Pot-friendly websites like Digg.com began directing massive traffic to news coverage that was critical of Kellogg's anti-marijuana posturing, thereby increasing the campaign's visibility among likely supporters.

As the chart shows, the company's stock took an immediate dive following its decision to drop Michael Phelps over the infamous bong hit photo. What began as a coordinated boycott by drug reform organizations quickly escalated into a full-blown media frenzy as major news outlets picked up the story. Pot-friendly websites like Digg.com began directing massive traffic to news coverage that was critical of Kellogg's anti-marijuana posturing, thereby increasing the campaign's visibility among likely supporters.

The cumulative impact of all this negative publicity is helpfully illustrated by The Vanno Reputation Index, which monitors the public image of leading corporations:

Kellogg Co. Stock -- February 2009:

As the chart shows, the company's stock took an immediate dive following its decision to drop Michael Phelps over the infamous bong hit photo. What began as a coordinated boycott by drug reform organizations quickly escalated into a full-blown media frenzy as major news outlets picked up the story. Pot-friendly websites like Digg.com began directing massive traffic to news coverage that was critical of Kellogg's anti-marijuana posturing, thereby increasing the campaign's visibility among likely supporters.

As the chart shows, the company's stock took an immediate dive following its decision to drop Michael Phelps over the infamous bong hit photo. What began as a coordinated boycott by drug reform organizations quickly escalated into a full-blown media frenzy as major news outlets picked up the story. Pot-friendly websites like Digg.com began directing massive traffic to news coverage that was critical of Kellogg's anti-marijuana posturing, thereby increasing the campaign's visibility among likely supporters. The cumulative impact of all this negative publicity is helpfully illustrated by The Vanno Reputation Index, which monitors the public image of leading corporations:

Out of the 5,600 company reputations Vanno monitors, Kellogg ranked ninth before it booted Phelps. Now it's ranked 83. Not even an industry-wide peanut scare inflicted as much damage on the food company's reputation. [Business Insider]

In the current economic climate, it would be silly to think we're solely responsible for Kellogg's falling stock. Still, the Vanno data clearly shows that we've dealt a substantial blow to the company's reputation at the worst possible time. Whether or not we actually had a considerable impact on Kellogg's bottom line is beside the point. What matters is that we sent an unprecedented message to corporate America that reefer madness is bad for business.

No comments:

Post a Comment